As I strolled down the winding campus streets of Makerere University on a calm evening, I met an acquaintance. Seated on a pavement near Mary Stuart Hall, he had his eyes firmly fixed on his phone. “I am here to connect to Mak Air (the free University WiFi) to download some reading materials from the class WhatsApp group,” he said when we got talking. “I have data, but I don’t have money to pay for OTT (Over-The-Top social media service tax).”

He is just one of the many Ugandan internet users who are struggling to connect to social media platforms because of the tax.

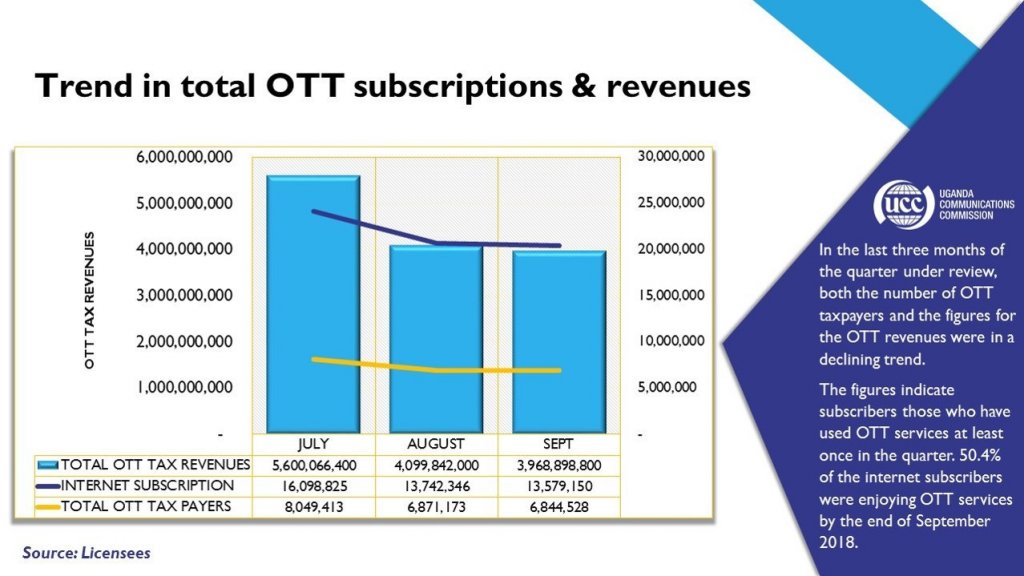

According to We Are Social and Hootsuite Digital 2019 report, the number of active social media users in Uganda dropped by 11 percent between January 2018 to January 2019. The number of mobile social media users also dropped by 12 percent during the same period while the number of internet users (not subjected to the social media tax) remained unchanged.

And yet, the folly and messy march by the Ugandan government to implement the repressive tax continues.

The controversial tax came into effect on July 1, 2018, after the passing of the Excise Duty (Amendment) Bill, 2018. The government argued that it was a move to increase the tax base and stop gossip. What the government will however not say is that the tax was introduced to smoother dissent online.

All internet users in Uganda have to pay the tax either daily (Ushs. 200/$0.05) or weekly (Ushs. 1,400/$0.36) or monthly (Ushs. 6,000/$1.56) or quarterly (Ushs. 18,000/$4.90) or annually (Ushs. 73,000/$19.9) to access social media sites or applications.

Shortly after the passing of the tax, in a last-minute bid to persuade President Yoweri Museveni not to assent to it, the Alliance for Affordable Internet (AAI) warned that if the new tax is enforced, Uganda’s poorest would be the hardest hit. They would have to fork out nearly 40 percent of their average monthly income for 1GB of data.

The law was, nevertheless, signed into law and the tax is well into the second year of enforcement. There have been tepid attempts by government officials to walk back from the tax, but nothing concrete.

What is new?

In a bizarre – but not surprising – move, Uganda’s chief tax collector Doris Akol, while appearing before the Parliament’s Finance Committee on January 14, 2020, proposed that instead of taxing users for accessing social media sites, the government should tax internet data directly.

In effect, what the Uganda Revenue Authority (URA) Commissioner-General Akol is proposing is a move from social media tax to internet tax. She argued that the policy shift would curb the huge evasions. It is, of course, foolhardy to imagine that the government does not know why the tax is being avoided. They know. But instead of eating humble pie by repealing the unjust tax, they are doubling down.

How a government official can propose such a policy shift is mindboggling. Here is why:

At a time when many governments across the world are struggling to get as many people as possible online to tap into the benefits of the digital revolution, the Ugandan government is enforcing policies that impede penetration.

Currently, users in Uganda pay one of the highest prices for internet data in Africa. According to several industry rankings, internet users in Uganda pay an average of $4.69 for 1GB of data – for generally poor and slow connections.

In comparison, consumers in Rwanda, the Democratic Republic of Congo (DRC), Sudan, and Burundi pay less than $1 for the same data package. In Kenya, users pay $2.73.

In a Uganda government National IT Survey 2017/18, 76.6 percent of internet users in Uganda cited the price of data as a key limitation on their use of Internet services.

Here’s what the government should be doing

In view of the prevailing situation that is backed up by data of government agencies, a sober government should be tackling the real challenges that the country faces to get more people online and advance the digital revolution.

The first thing is to immediately scrap the social media tax. It is an unjust tax, promotes net neutrality, impedes freedom of expression online, and frustrates small and medium enterprises that depend on social media for marketing and consumer feedback. In this digital age, it is almost impossible to attain freedom as expected without freedom of the internet.

The government should also take deliberate steps to increase internet penetration to lower unit cost of data. Research shows that low internet usage is one of the key drivers of high costs of data. What the social media tax does it to slow down penetration and data consumption, thereby risking to rise the data costs even higher.

It is incongruous that the telecoms have been left to fight a lone battle of driving internet penetration through data package deals; which, unfortunately, also encourage net neutrality.

The Ugandan government should also improve on the internet infrastructure. The study by a government agency quoted above shows that 49.2 percent of internet users are frustrated by very slow internet speeds. Further, 41.4 percent of respondents reported limitations associated with failure to access internet services due to a lack of network/connectivity in their areas.

The Ugandan government, like other governments across Africa, needs to take action to ensure that everyone in Uganda has fair and equal access to life-changing digital connectivity.